The intraday strategy automates and minimizes the work with dynamic lines.

The intraday strategy has two main trading strategies:

- Breakout

- Support

The "Breakout" strategy

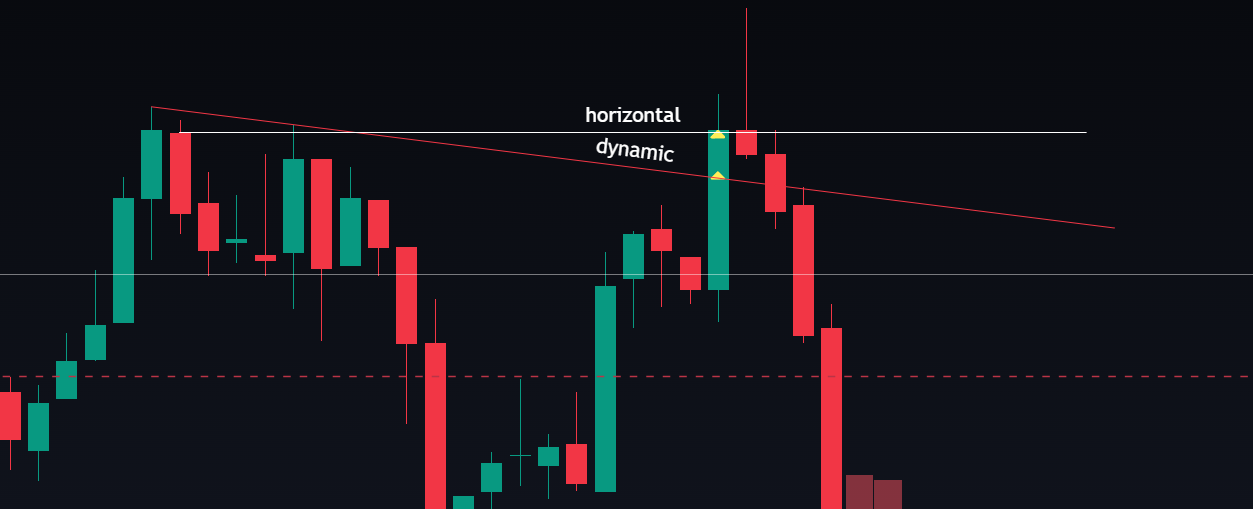

There is a breakout of both the dynamic and horizontal lines.

How it works

The strategy task is autonomous tracking of the price and the line on which the strategy is. The strategy activates at the right moment and executes an order according to a set config. Then the strategy places a take-profit order, and in case of a price reverse down, the strategy trails up a stop loss from a buy level or a dynamic line. When the price touches one of these, the strategy executes the stop loss automatically.

Extra tips:

- Standard templates suits for testing but not for trading, each asset should have individual activation and buy parameters.

- Stop loss and take-profit orders are very different and should be set individually for a traded asset.

- Breakouts have more chances to occur on a compressed (at an acute angle) pattern.

The "Support" strategy

There is as well a breakout of both the dynamic and horizontal lines.

A Dynamic (or a trend) line takes shape at an early stage of trend formation.

After having a line on two extremes, we can expect a rebound when a price touches the line next time. Prediction of this event is impossible, so in any case, The strategy buys on the line automatically.

The horizontal line can serve both as a resistance level during a breakout and as a support level.

Following the example of an image on the left, the first step is to buy in a breakout, start the strategy on the same line and use the "support" strategy to retest the breakout and expect further growth.

- Also, the intraday strategy "support" strategy (an image on the right) can replace the fibo strategy.

The intraday strategy can perform the "Aftershock" trading strategy. Only not with a grid but with a separate strategy on each of the levels.

- This technique requires training and understanding of work with levels.

- The advantage of the strategy is higher profitability when keeping to P&L (profit and loss statement) in trade.

How it works

The "support" strategy works by analogy with the "breakout" strategy.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article